Client

Thinksurance

Industry

Insurance

Technologies

Node.js, SASS, PHP, Git, Docker, Selenium

About the project

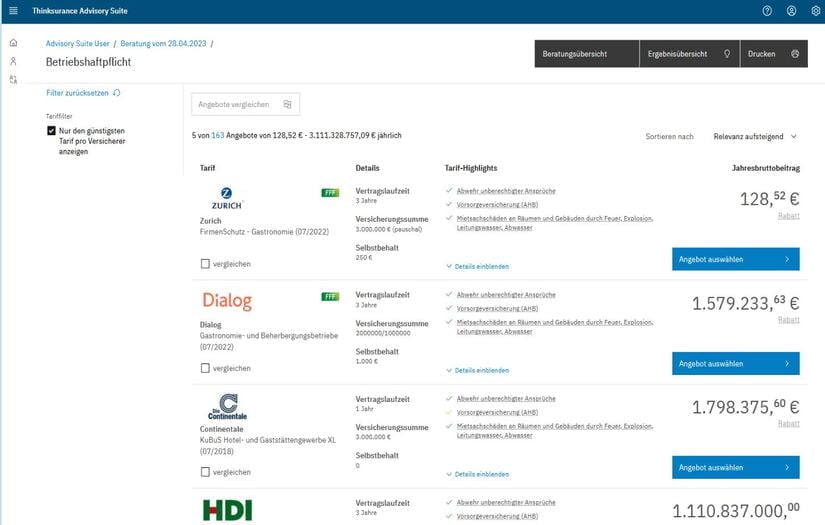

Thinksurance is a Germany based company that offers a digital platform solution to the insurance market that links all relevant market players in the field of commercial and industrial insurance. The platform makes it easier, faster and more effective for insurers, brokers and policyholders to exchange information, making all the offerings more comparable.

Before the implementation of the insurance B2B comparison platform, the customer was using a legacy PHP system that was not meeting their needs. The platform was not able to effectively connect with various insurers and had complicated comparison algorithms.

Challenges

The project presented unique challenges as it involved a start-up that was building itself up from scratch, creating something completely fresh and new. The team was uncertain about the implemented architecture and whether it was working as intended. This uncertainty created a need for consultancy and guidance, which our team successfully provided.

As experts in modern microservice architecture, React, and Node.js, we offered valuable insights and recommendations to ensure the optimal performance, scalability, and robustness of the architecture.

Solution

The company did not have the necessary internal resources to make the switch from a legacy PHP system to a modern microservice architecture, so the solution was to look for a partner that can complement their development department.

The customer selected our team as a vendor based on our expertise in React and Node.js and our vast experience in developing modern microservice architectures. They were impressed with our ability to transform the legacy PHP system into a more modern and efficient platform.

Our team was able to develop a modern microservice architecture that effectively connects with various insurers and includes state-of-the-art libraries and frameworks.

The implementation of the insurance B2B comparison platform was successful. The platform now has modern deployment pipelines and infrastructure as code.

Technologies used

Results

The key business benefits of the insurance B2B comparison platform include increased efficiency and cost savings for the customer. The modern microservice architecture allows for more efficient connections with insurers, which can lead to better rates and lower costs for the customer. The improved platform also allows for higher customer satisfaction and loyalty, as it provides a more seamless and efficient user experience.

Perspective

The key variables that have led to a strong collaboration/partnership with the customer include our team’s expertise in modern microservice architecture, React and Node.js, and our ability to meet the specific requirements of the customer. Our team also provided excellent customer service and ongoing support, which helped to build a strong relationship with the customer.

As a result, our team continues to augment the client’s team in their agile ongoing development and to provide ongoing development and support for the customer. The customer plans to continue their collaboration with our team in order to stay at the forefront of technology and maintain a competitive edge in the market.

As a dedicated software development team with expertise in nearshore software development, software development outsourcing, IT staff augmentation and many more, we specialize in providing innovative solutions across industries, from custom manufacturing software development to business process optimization, ensuring that our clients remain competitive and efficient in their operations. Check out our software development projects here.